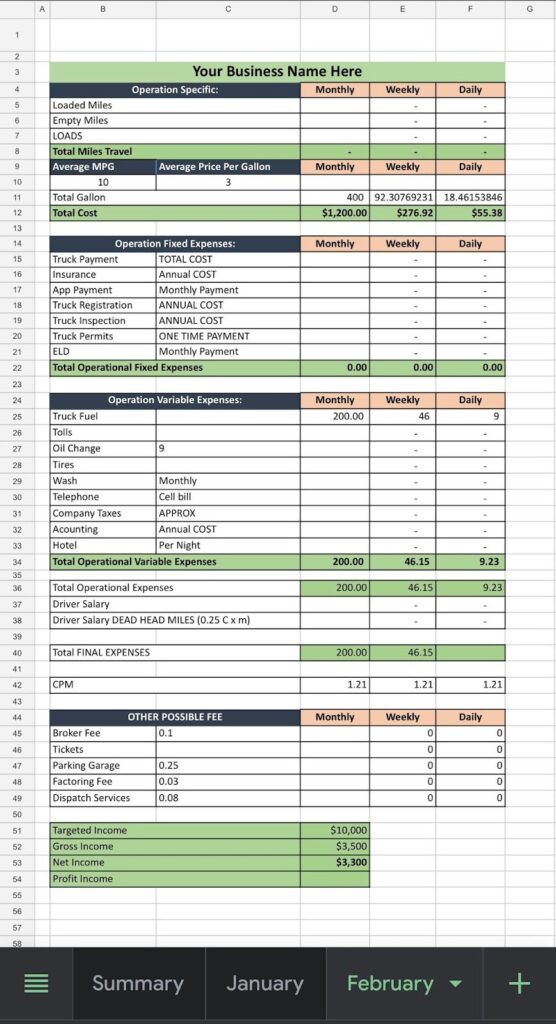

In the trucking sector, revenue is frequently reduced to basic figures: rate per mile, loaded miles, fuel cost, and utilization. Whenever the numbers do not measure up, fleets normally look for reasons in dispatch strategy, broker negotiations, or equipment efficiency. Meanwhile, compliance is generally viewed as being a matter of secondary importance — a necessary but seemingly unrelated aspect to raising revenue.

Optimizing revenue in trucking often begins not with pricing tactics, but with structural discipline across operations and compliance processes.

As a matter of fact, compliance is the factor that immediately changes the way in which revenue is generated, safeguarded, and maintained. The extent of adherence to regulations, whether true or false, has a direct impact on the operational focus, load quality, payment reliability, and long-term financial stability. Transport companies that have a grasp of this interplay do not look at compliance as a cost driver — they rather consider it as a particle being actively involved in the business success.

The reading here is on the effects of compliance discipline on revenue in truck driving, the reasons compliant carriers tend to carry better loads, and how the minimization of compliance risk leads to the unlocking of stronger revenue streams.

Compliance Does Not Cost Money; It Generates Money

It is a common mischaracterization in the trucking business that compliance is something that consumes resources without producing tangible benefits. Things like documentation, audits, tax compliance, and internal controls are often put together as “non-driving costs.”

Tax obligations are part of the same revenue system as dispatch, billing, and asset utilization, even if they are rarely discussed in that context.

However, revenue is not independent of organization. Every dollar earned relies on a bouquet of trust that involves brokers, shippers, insurers, lenders, and regulators. Compliance is the fabric of which this trust is made.

Taking it away, the revenue cycle becomes fragile; lurking audits, payment delays, insurance hikes, and operational hiccups could happen. Retaining it, on the other hand, makes revenue consistent and scalable.

Compliance is not the carrier against the loss; it is an architecture that lets revenue flow very well.

The Hidden Cost of Compliance

Compliance slips do not usually sweep away revenue in a day. They usually have a long-term effect by producing friction and distraction.

Some examples of common revenue leaks due to compliance risk include:

| Compliance Gap | Revenue Impact |

| Incomplete documentation | Delayed invoicing and payment holds |

| Audit exposure | Management time diverted from operations |

| Inspection violations | Reduced broker trust and load access |

| Tax compliance issues | Cash flow restrictions and penalties |

| Record inconsistencies | Billing disputes and write-offs |

Unpaid tax debt often becomes a silent operational drag long before it shows up as a direct financial penalty.

Each of the above problems seems manageable by itself. But collectively, they weaken the revenue cycle and lead to the reduction of effective productivity.

In the trucking business, distraction results in lost income.

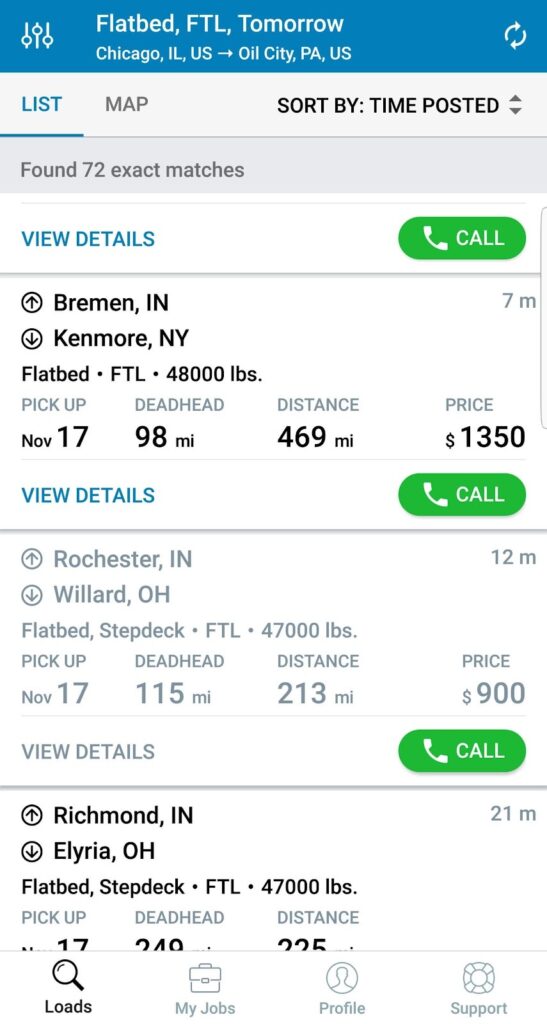

Discipline Is the Key to Access to Better Loads

Higher-quality loads are not randomly given out. Not at all. It is as if they are being reserved for only those carriers that show operational consistency and have almost no compliance risk.

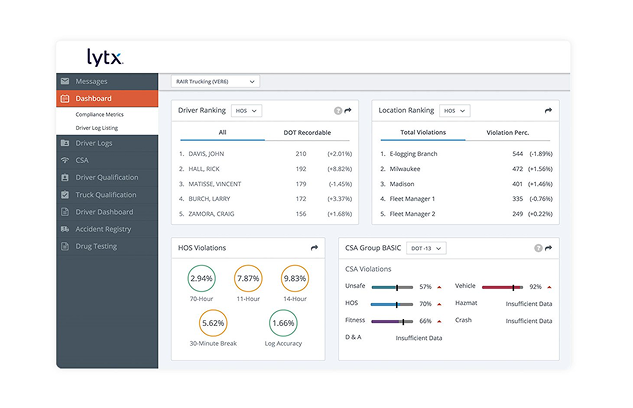

Shippers and brokers tend to prefer fleets that can demonstrate:

- Uninterrupted compliance

- Impeccable audit reports and DOT inspections

- Documentation processes that are reliable and quick

- Low disruption risk

Minimizing risk across compliance operations directly improves a carrier’s position in competitive load selection.

The practice of compliance discipline reduces risk. The outcome is that the carrier is more appealing to long-term contracts, trucks with higher value, and priority lanes.

The truth is, good loads follow discipline — not reductions in price.

Compliance and Revenue Integrity

Revenue integrity encompasses the degree to which earned revenue is likely to be collected. Compliance is instrumental in protecting this aspect in the trucking industry.

The areas of compliance that help to ensure revenue integrity:

| Compliance Area | Revenue Effect |

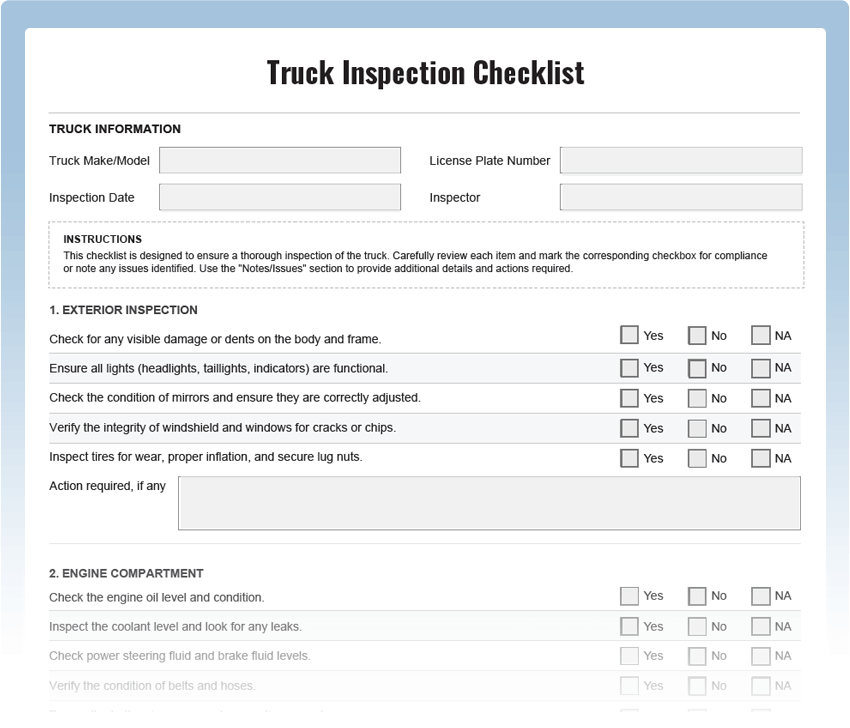

| Correct logs and records | Faster invoice approval |

| Increased cleaning inspections | Fewer payment freezes |

| Proper documentation | Lower dispute rates |

| Consistent policies | Predictable cash flow |

Sustained concentration on documentation accuracy prevents revenue erosion at the collection stage.

Disputes, audits, and payment delay revenue that is already earned but has not been realized at the time. In this context, compliance is a guarantee to ensure that revenue travels safely from the load acceptance stage to the payment stage.

Tax Compliance: The Unnoticed Revenue Multiplier

Tax obligations are hardly the central topic in any discussion of revenue optimization, but they greatly affect financial stability nonetheless.

Unsettled tax liabilities can trigger a snowball impact of operational issues:

- Account levies

- Credit tightening

- Licensing complications

- Increased scrutiny from regulators

Strong tax discipline protects organizational resources from being diverted into crisis management.

As a result of these problems, the management team is faced with a crisis, which, in turn, draws their minds away from productivity and growth.

On the other hand, fleets that comply with the tax rules get the respect and trust of lenders, improve their liquidity, and have stable revenues — even in an unpredictable market.

Productivity as a Compliance Result

In trucking, productivity is often counted in miles or hours. Productivity, in the physical plane, depends as much on intellectual clarity and organization of attention as on anything else.

The absence of compliance systems allows the teams to spend the time:

- Hunting for documents

- Talking about inconsistencies

- Responding to audit requests

- Fixing preventable errors

Increased productivity is often a byproduct of structured compliance rather than operational acceleration.

The pressure of weak compliance discipline has been considerable. It has obstructed such drivers, dispatchers, and managers to run the business but rather correct mistakes.

Compliance Discipline versus Productivity

| Compliance State | Productivity Effect |

| Reactive compliance | Constant interruptions |

| Inconsistent records | Slower decision-making |

| Structured compliance | Focused operations |

| Audit readiness | Higher output per asset |

The higher productivity can be achieved, in the end, by the same assets being more productive.

Billing Compliance and Revenue Optimization

One major setback in the trucking is that billing compliance is one of the most underappreciated means of increasing revenue.

Paperworks with correct details, confirmations of rates that do not conflict, and reliable supports lead to results such as:

- Accelerated payment cycles

- Less disputes

- Decreases in write-offs

- Strengthened broker relationships

Compliance does not add to costs; instead, it organizes the process to ensure that the entitled revenue is in fact received.

In several fleets, the solitary goal of augmenting the billing compliance is sufficient to bring about a tangible increase in revenue.

Organizational Resources and Compliance Leverage

Every trucking operation works under vehicular constraints: time, capital, and attention.

Poor compliance tends to consume this resources in a disorganized manner because of the:

- Firefighting

- Repeated corrections

- Emergency responses

Conversely, the disciplined compliance system employs these same resources for leverage in the form of:

- Reducing audit pressure

- Stabilizing operations

- Supporting strategic planning

This creates space for growth initiatives, fleet upgrades, and revenue expansion.

Minimizing Risk Is a Revenue Strategy

The world of trucking is such that risk and revenue are two interlinked concepts. Every compliance failure dislocates the revenue stream.

Minimizing compliance risk:

- Protects existing revenue

- Prevents operational shutdowns

- Preserves customer confidence

If properly viewed, compliance discipline is not confining but a kind of insurance for revenue.

Final Thoughts: Discipline Is the Quiet Engine of Revenue

In the truck driving sphere, the growth of revenue is not propelled only by miles or rates but also by stability, trust, and focus.

Compliance discipline:

- Safeguards the revenue cycle

- Upholds revenue integrity

- Boosts productivity

- Enables access to better loads

- Reduces operational risk

Fleets that see compliance activity merely as an afterthought confront scaling problems. This is, however, an issue that fleets which weave compliance into their day-to-day operations do not have as they create a path for durable and regular revenue.

Compliance is not about restriction.

It is a method of creating a system that enables cash flows quickly and sustainably.

FAQ: Compliance, Revenue, and Load Quality in Trucking

1. How does compliance impact truckers’ revenue?

When compliance is performed perfectly, the flow of business operations improves, thus saving time and reducing the burden of managing issues. Clean records, accurate logs, and consistent documentation accelerate billing, reduce disputes, and prevent payment holds. This allows earned revenue to be collected faster and more reliably.

2. Why do refrigeration fleets get premium loads?

Transportation agents and manufacturers rank carriers with low compliance risk first as they are the least likely to cause delays, inspections, or any other disruptions. First-rate compliance is the transparency that generates access to high-quality cargo and long-term contracts.

3. Can non-compliance even cost you revenue if the rates are excellent?

Absolutely. Although the rates may be favorable, delays in the invoicing of goods, interruptions caused by the audit, operation errors, or tax compliance difficulties can all lead to a loss of income.

4. In what way does tax compliance correlate with trucking revenue?

Tax compliance aids in protecting liquidity and access to credit. Involuntary tax compliance creates levies, licenses denial, and spin-off management attention, and finally, it undermines revenue.

5. Does compliance mostly focus on avoiding penalties?

No. Avoiding fines is a secondary benefit. The primary value of compliance is in the verifying of the correctness of the income acquired which is done without the involvement of any delays, disputes, or any operational interruptions.

6. How can compliance boost productivity?

The application of compliance in a structured manner leads to a net reduction on the time needed for making corrections, explanations, and emergency responses. The time thus available would be better spent by the drivers, dispatchers, and managers on executing their tasks rather than having to fix preventable errors.

7. What part does billing compliance have in revenue optimization?

The billing compliance confirms that the required paperwork, the right prices, and other documents are the same. As a result, this will lengthen the payment cycles, cut off on-write-offs, and positively boost broker relationships.

8. Are small truck fleets productive with compliance discipline like the bigger carriers?

From experience, they can be even more productive. Small fleets have a higher risk of cash-crunches, audits, and other factors that can delay payment. Adhering to strict compliance standards provides them with stability and creates a positive perception among customers which promotes consistent revenue.

9. Does compliance discipline hinder the speed of operations?

In the beginning, it might seem slow due to formality. Later it will eliminate the interruptions and confusion thus making the operations more effective and the production capacity of each asset higher.

10. Is compliance a growth strategy or just a control tool?

It’s both. Compliance discipline builds the base on which the growth can happen without jeopardizing revenue, trust, or operational capacity.