Trucking profitability is hardly derived from rates alone. The real difference between a marginal operation and a consistently profitable one often lies much deeper — it is in the ownership costs associated with the equipment class. Two trucks can have a similar revenue-per-mile generating capacity but might yield very different net returns after the full cost structure is applied. Operators often find themselves in this situation, unaware of the losses incurred.

The idea of ownership costs across various equipment classes is not simply related to the cheapest truck selection. It is about discovering the place where the hidden margin abides for the whole asset life cycle. The present article presents a cost comparison of various types of equipment focusing on total ownership costs (TCO), operating costs, asset utilization, and long-term financial consequences.

Equipment Class: The Untold Importance

The equipment class signifies more than size or horsepower. It also indicates how depreciation, maintenance, fuel efficiency, and resale value will behave. From a fleet manager’s view, the equipment class defines how capital expenditures turn into either working assets or liabilities.

A lot of owner operators are concerned about the payment rate per month, or the costs associated with buying the machinery. But, one cannot really say that margin is being made at the time of purchase. Instead, it is made — or destroyed — over the years of operation, the patterns of downtime, and the value at exit.

A proper class comparison should take into account:

- The rate at which equipment loses its value

- Maintenance costs’ variability and predictability

- Revenue hours generated by the asset

- The flexibility of equipment among the different freight types

Total Cost of Ownership (TCO): The One and Only Absolutely Important Metric

The total cost of ownership (TCO) is the most necessary element of a serious financial analysis in trucking. The TCO is basically the sum of all costs that one incurs directly or indirectly in relation to owning and running the equipment over its entire lifetime.

Understanding Total Cost of Ownership (TCO) for Your Fleet

Significant TCO components:

- Equipment finance and acquisition

- Depreciation and residual value

- Maintenance and repair expenses

- Fuel consumption differences

- Insurance and registration costs

- Downtime, decreased efficiency

For two equipment classes that are similarly priced but have totally different outcomes, TCO is influenced significantly by the factors mentioned above.

Core TCO Components by Equipment Class

| Cost Component | Light Equipment Class | Heavy Equipment Class |

| Initial acquisition | Lower | Higher |

| Depreciation speed | Faster | Slower |

| Maintenance costs | Less predictable | More predictable |

| Fuel efficiency | Higher unloaded | Higher under load |

| Residual value | Lower | Higher |

| Downtime impact | Higher | Lower |

Lighter vs. Heavier Classes: A Fundamental Cost Analysis

Lighter classes always appear more appealing due to lower financing requirements. But, they hide risky operational pitfalls incurred when these units are used beyond their optimal cases. On the flip side, heavier equipment classes attract bigger initial investments yet they usually outperform smaller ones under constant workloads.

Cost structure-wise:

- Light-duty equipment is more likely to devalue because of heavy use

- Heavy-duty equipment, on the other hand, is kept longer leading to more residual value

- Maintenance costs differ with load stress

- Fuel efficiency gains can be lost through underutilization

The truck does not get its size, but the equipment class fitting to the operational situation is what the margin is in.

Depreciation and Residual Value: The Mysterious Margin Killers

Depreciation is one of the most overlooked costs of ownership. Operators often only see it as the loss in resale value — long after the real issue has taken place.

The equipment class is key to the depreciation:

- A maxed-out increasingly reduces value for the owner

- A minimalist engine with high hours on it reduces the value of the equipment much more than expected

- There are some classes that frequently have a strong secondary market

- There are also those that tend to collapse in no time when their warranties end

With equipment that has more value residual margins can be found — or just the other way around. Equipment that goes with the fleet element that is in considerable demand tends to uphold its value better, even if the mileage is higher.

Cost of Maintenance and Predictability

Maintenance costs refer not only to the money that you invest but also to the predictability of these expenses. When it comes to equipment class, it is the key to wear patterns, component lifespans, and failure frequency.

Class-specific major differences:

- Heavier-duty models usually have an increased per-event expense but fewer outliers

- The lighter classes tend to break down frequently

- Some classes are susceptible to the lack of maintenance

- The actual existence of parts and service regulates across the fleet

From a margin viewpoint, predictability often weighs more than a lower average cost. The effect of unplanned repair time on asset utilization is among the most concealed costs of the company.

Finding Illegitimate Choices with Fuel Efficiency

Fuel efficiency is often mentioned as the most significant criteria when selecting a truck, but it really depends on the utilization. Sitting idle, a fuel-efficient truck may destroy the margin faster than a less-loaded truck that is less efficient.

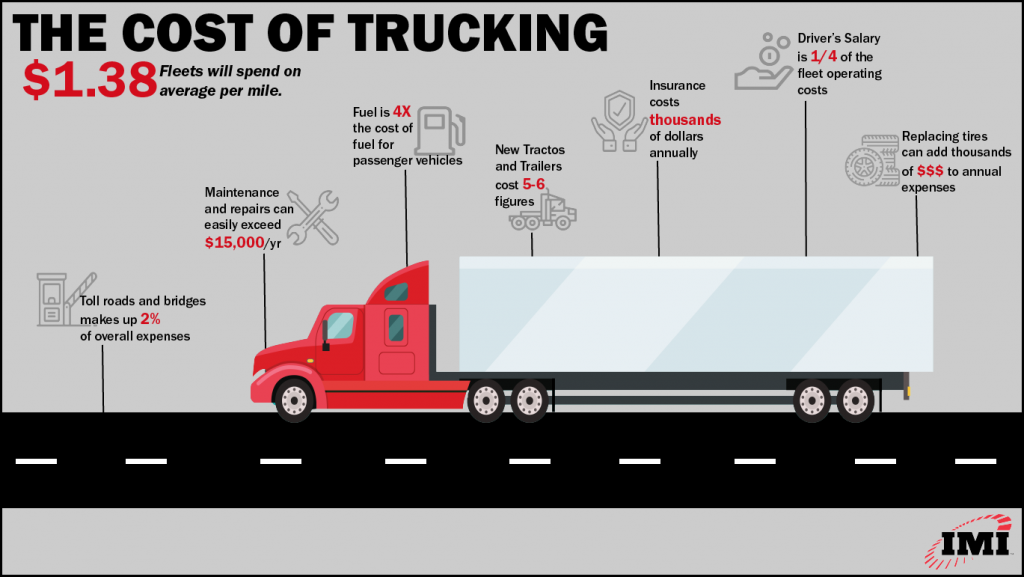

Trucking operational costs 2024: What fleets need to know

Equipment class has an impact on:

- Engine operation ranges

- Optimal load windows

- Aerodynamic factors

- Idle sensitivity

A true cost comparison of fuel efficiency should be made after revenue-generating hours, instead of analyzing them in isolation.

Asset Utilization: The Real Margin-Generating Area

Asset utilization is often the least noticed aspect of ownership cost analysis. The optimal equipment class is not the one with the least specs but the one that remains productive for a longer time.

High utilization will decrease the following:

- Cost per mile

- Cost per hour

- The impact of fixed operating expenses

Mismatch equipment even if argued to be “better” leads to:

- Increased deadhead

- Missed freight opportunities

- Increased effective ownership costs

The way equipment works, not the way it looks on paper is where the real margin is hidden.

Asset Utilization Impact on Ownership Costs

| Utilization Factor | High Utilization | Low Utilization |

| Cost per mile | Lower | Higher |

| Fixed cost impact | Diluted | Concentrated |

| Revenue consistency | Stable | Volatile |

| Effective TCO | Reduced | Increased |

| Margin sustainability | Strong | Weak |

Capital Expenditures vs. Cash Flow Realities

Calculating capital expenditures are uncomplicated. But, figuring out cash flow is not.

The different equipment classes can change:

- Monthly debt load

- Insurance premiums

- Repair reserve needs

During market downturns

Investing too much in equipment results in the lack of flexibility. On the other side, not investing enough due to inefficiency and more rapid wear is the longer-term problem with machinery.

Even equipment ownership that is balanced will be supporting stable cash flow which is a significant but unnoticed factor for margin creation.

Fleet Management Consideration: The Cost Structure Lifeblood

For the fleet, class comparison becomes even more crucial. A minor inefficiency multiplies by dozens or even hundreds of units.

From the fleet management viewpoint:

- Standardized equipment classes make maintenance much simpler

- Mixed classes boost admin and training costs

- Residual value planning is a strategic act

- Equipment ownership decisions underline long-term competitive edge

Hidden margin at fleet scale often results from simplification instead of optimization.

Comparative Analysis of Long-Term Ownership: Where the Margin Is Hidden

A meaningful comparative analysis of equipment ownership goes far beyond surface-level numbers. The margin hidden inside different equipment classes reveals itself only when long-term costs are evaluated together, rather than in isolation. Equipment acquisition price is merely the opening line of the financial story, not its conclusion.

When machinery costs are spread over several years, differences in maintenance costs, depreciation behavior, and operational reliability become far more influential than initial purchase figures. Two units acquired at similar prices can diverge sharply in profitability once service intervals, component replacement cycles, and unscheduled repairs are factored into ownership.

This is where long-term costs reshape decision-making. Equipment with slightly higher upfront acquisition costs may preserve margin through slower depreciation, predictable maintenance schedules, and stronger residual value. Conversely, machinery that appears economical at purchase can quietly erode profit through frequent downtime, volatile repair expenses, and accelerated value loss.

The true margin hidden in equipment class selection is uncovered only when equipment acquisition, machinery costs, maintenance costs, and utilization are viewed as a single system. Operators who evaluate ownership through this broader lens gain a clearer understanding of how long-term financial outcomes are formed — and why some equipment consistently outperforms others despite similar revenue profiles.

Where The True Hidden Margin Lies

The hidden margin is not usually in the price but mostly resides in:

- Slower depreciation

- Higher resale value

- Stable maintenance

- Consistent asset utilization

- Flexibility in deployment across freight cycles

The operators that are really ahead of the game recognize that the ownership cost varies with equipment class and thus they do not run after the cheapest truck. Instead, they choose the one that aligns economically the best.

Wrap Up

The task of comparing equipment class ownership costs is not a theoretical task but a core competency of a modern truck driver that helps them survive in the rough field. It is not in the fuel per se that margin is found or through negotiation gained. It is, very slowly, determined by the long-term spend, utilization as an asset, and the degree to which equipment ownership matches operational reality commendably.

The operators that habitually raise the bar in performance, are neither the ones with newly acquired, heavily imposed trucks, nor those with massive engines fitted to the cars. They are the ones who discern the hidden margin pictorially and precisely build their equipment strategy around it.

FAQs: Ownership costs, equipment classes, and hidden margins

1. Firstly, why is it that the ownership cost is so variable among the equipment classes that have much the same purchase price?

The purchase price reflects only the acquisition of the equipment, not the cost structure as a whole. Equipment classes show different behaviors in terms of shortening the life span of the parts, increasing maintenance expenses, better fuel consumption with load, and the final revaluation of the asset. For instance, two truck brands may have the same price initially but their costs on the long run can really differ after repairs, downtime, and resale are considered.

2. Secondly, is the total cost of ownership (TCO) more significant than only operating expenses?

Certainly, TCO is a more comprehensive picture than the segment of the operating expenses data. TCO includes machinery costs (including depreciation), operational costs, equipment downtime, and asset utilization. Seeing only one side of the picture, such as focusing on fuel use or maintenance expenses, often covers up the place where the real margin is gained or lost.

3. Thirdly, what effect does the equipment class have on maintenance costs through time?

Equipment class plays a key role in determining component strain levels, service intervals, and failure patterns. Higher-duty classes, in many cases, have higher per-event repair costs but less frequent unexpected failures. Lower grades might seem to be less expensive at first, but they are frequently the cause of the unpredictable maintenance costs that take over the long-term profit margins.

4. Fourthly, can you become more profitable just by having a higher fuel efficiency?

Not necessarily. Fuel efficiency has to be reviewed together with equipment utilization. A fuel-efficient truck that lies still or bears an undersized load can demolish profit faster than a unit that is less efficient but is consistently bringing in money. The equipment class dictates the working area where fuel efficiency actually adds to the profit.

5. And where does the hidden margin in equipment ownership normally exist?

The hidden margin in equipment ownership is there in the form of less depreciation, the high residual value, predictable maintenance costs, and stable asset utilization. These factors are just accreting through the years and sometimes they will be even bigger than the differences in purchase costs or the performance that is announced.

6. How does asset utilization affect ownership expenses?

High utilization is a way of spreading fixed ownership costs in more revenue-generating hours, therefore lowering cost per mile and cost per hour. Mismatched equipment classes, on the other hand, create a lot of downtime, missed freight opportunities, or inefficient deployment, thus, owning the equipment effectively increases the costs significantly.

7. Furthermore, what makes equipment acquisition strategy the most important decision during a market downturn?

Downturns are accompanied by cash flow pressures. Equipment classes that have high capital expenditures, volatile maintenance costs, or weak resale markets would not be flexible. Balanced equipment ownership is a means of maintaining cash flow and preserving margins when freight demand fluctuates.

8. Should fleets stress standardization instead of optimization?

As a matter of fact, yes, in many cases. Fleet management is greatly benefited by the standardization of equipment classes because they minimize maintenance complexity, training costs, parts inventory, and administrative overhead. Hidden margins gained through scale often come from simplicity rather than being obsessed with minor performance differences.

9. Is depreciation really a controllable cost?

Indirectly, yes. Depreciation behavior depends on equipment class selection, utilization patterns, and market demand at resale. Making a choice of the equipment that aligns with common freight profiles and the secondary market demand helps in protecting residual value and reducing long-term ownership costs.

10. How should owner-operators deal with a comparative analysis of equipment classes?

Owner-operators should conduct a comparative analysis based on a full life cycle perspective: acquisition of equipment, cost of maintenance, fuel consumption under realistic load conditions, asset utilization, and exit value. The wish is not to buy the cheapest truck but to keep the margin in good shape over the years.